OURBORO INVESTMENT MANAGEMENT

A New Path to Residential Real Estate Returns

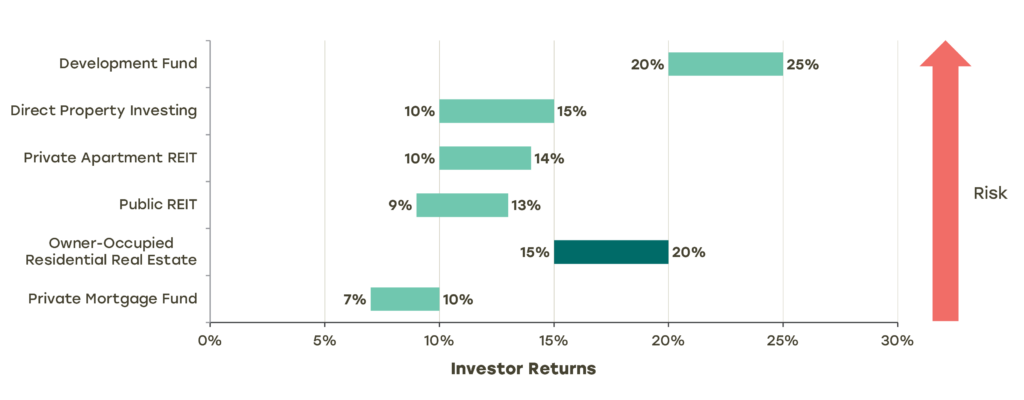

Gain exposure to owner-occupied homes in Canada, without landlord or debt obligations.

Why Investors Choose Ourboro

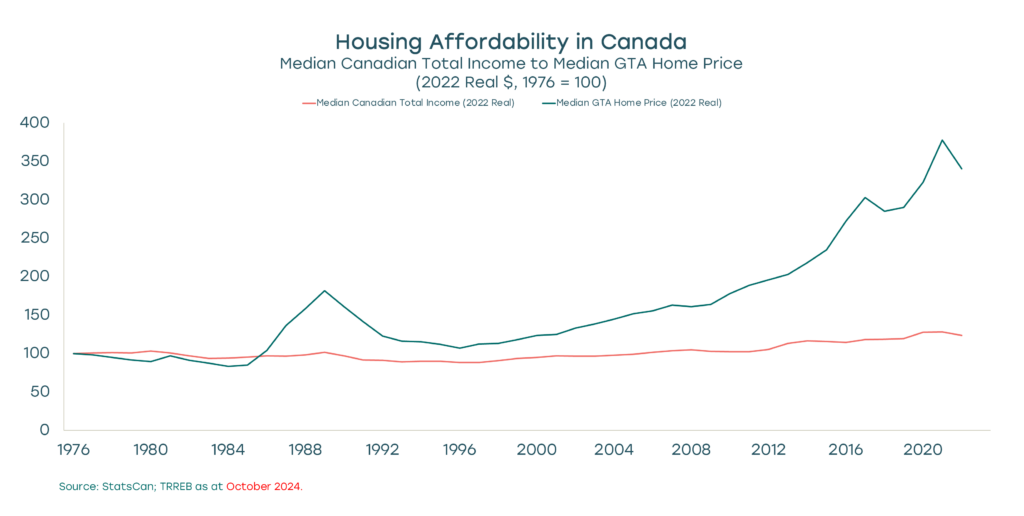

Canada’s pent-up homeownership demand is constrained by the down-payment gap, an estimated $25B opportunity through 2026*. Ourboro bridges the gap, enabling families to buy today while delivering resilient, downside-protected returns. With its defensive profile, the strategy is tailored for pension funds, family offices, and private investors seeking stable real estate exposure.

Homes across GTA, Southwestern Ontario, and Ottawa, varied by built type and price point.

By partnering with owner-occupiers, Ourboro investors access 4x mortgage leverage, without servicing the debt.

No tenants, no maintenance, no vacancies. Ownership is through a tax-efficient private equity structure.

*Source: Statistics Canada; 2024 CIBC Millennials & Homeownership Poll.

A Strong Track Record

co-owned homes

in asset book value

applications from qualified homebuyers

Our Investor Community

“Ourboro’s co-ownership model is transforming the path to homeownership, empowering families to move in today, build equity for tomorrow, and create generational wealth.”

- Miles Nadal, Founder and Executive Chairman of Peerage Capital

“What is interesting and different about Ourboro is they have structured it as actually owning a piece of the home.”

- Jaime McKenna, President of Fengate Real Estate, Fengate Asset Management

Unlocking the Hidden Potential

Ourboro gives you access to an untapped asset class: owner-occupied residential real estate. By co-investing across Ontario, we help Canadians achieve homeownership while delivering strong, risk-adjusted returns for investors. With aligned incentives, families and investors both win when the home appreciates.

Ourboro invests in resilient real estate across regions and property types to deliver balanced, lasting growth. Connect with us to see how it can work for you.

Ourboro invests in resilient real estate across regions and property types to deliver balanced, lasting growth. Download our Investment Overview to learn more.

Building Real Impact Beyond Returns

In a landscape where many ESG strategies in Canada focus narrowly on environment or governance, Ourboro emphasizes measurable social impact. That’s why we’ve partnered with Conestoga College on a 10-year study to measure how shared equity homeownership impacts quality of life compared to renting, tracking outcomes across several key areas:

Improved quality of life and wellbeing

Stronger financial stability and housing security

Greater connection to community and education

Increased trust and sense of safety

Learn more about our Impact Study.

Learn how shared equity can support your real estate portfolio

Book a call with us today.

Learn how shared equity can support your firm's investment thesis

Download our Investment Overview today.

By providing your information, you agree to receive communications about relevant content, news, and updates from us. You can unsubscribe at any time.

*Source: Statistics Canada; 2024 CIBC Millennials & Homeownership Poll; Canadian Real Estate Association

(1)Extrapolated based on the number of Canadian households in the 25-44 age bracket that were either renting or living with their parents for non-caregiving reasons in 2023, along with 2024 data from the Royal LePage 2024 Renters Report indicating that 27% of renters plan to purchase a property in the next two years and of those 27%, 50% declare they are lacking the funds/savings to be able to afford a 20% down payment. Assumes an average home value in Canada of $718.7K (Trading Economics) and 67% average Ourboro contribution (historical average).

Confidentiality: This presentation and all the information contained herein is confidential, proprietary and for the use solely by the prospective investors and their professional advisors. Any person reviewing this presentation agrees not to do any of the following in respect of this presentation or any information contained herein without the prior permission in writing from Ourboro Inc. (“Ourboro”) or its representatives: (1) use; (2) disclose or divulge; (3) copy; (4) retain; (5) reproduce; (6) publish; (7) transmit; (8) make available; or (9) condone, permit or authorize the use, disclosure, copying, retention, reproduction, publication or transmission thereof, including to the public or the media, unless it is solely for the purpose of evaluating a potential investment in the securities described in this presentation (the “Offered Securities”). In consideration for the time and effort expended by Ourboro or its representatives to prepare this presentation, these obligations shall survive indefinitely, whether or not a prospective investor acquires any Offered Securities.

Disclaimer on Forward-Looking Information: This presentation may contain certain forward-looking statements. These statements relate to future events or future performance and reflect expectations of management of Ourboro regarding the growth, performance values, proceeds of realization and financing and business prospects and opportunities of the fund being promoted by Ourboro. Such forward-looking statements reflect management’s current beliefs and are based on information currently available to management. In some cases, forward-looking statements can be identified by terminology such as “may”, “will”, “should”, “expect”, “plan”, “intend”, “anticipate”, “believe”, “estimate”, “predict”, “potential”, “continue”, or the negative of these terms or other comparable terminology. A number of factors could cause actual events or results to differ materially from the results discussed in the forward-looking statements. Although the forward-looking statements contained in this presentation are based upon what management believes to be reasonable assumptions, Ourboro cannot assure investors that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this presentation or as of the effective date of information described in this presentation, as applicable, and Ourboro does not assume any obligation to update or revise them to reflect new events or circumstances, except as required by applicable securities legislation.