2025 was a challenging year for Canadians navigating the housing market. With tariff tensions and rising living costs, the path to homeownership in Canada often felt more uncertain than ever.

Amid these challenges, Ourboro’s focus has remained the same: supporting Canadians who are ready to buy a home but facing barriers that feel out of their control. As we reflect on 2025, our gratitude outweighs everything. Thank you for the trust you’ve placed in us and for the progress we’ve made together.

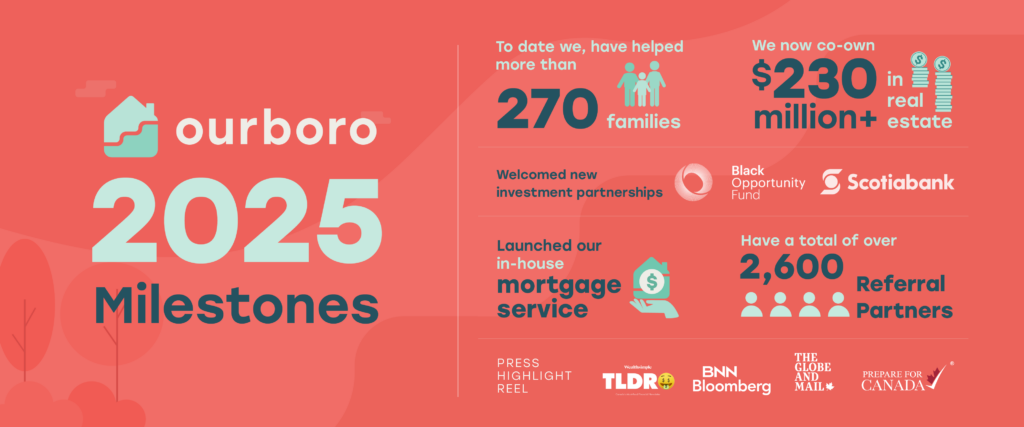

Ourboro’s 2025 Milestones at a Glance

Despite these uncertainties, more Canadians turned to co-ownership as a pathway to buying a home.

Since our launch, we’ve seen incredible momentum:

- Over 3,000 applications from Canadians exploring co-ownership.

- Over 270 homeowners now co-own with Ourboro—and 9 out of 10 would refer us to a friend.

- We now co-own more than $230 million in real estate across Ontario.

- Our Referral Partner network grew to over 2,600 real estate agents and mortgage professionals.

These numbers highlight the growing interest in down payment assistance programs at a time when traditional homeownership feels increasingly out of reach.

New in 2025: Expanding Access to Homeownership

Launching Our In-House Mortgage Service

To help buyers navigate the homeownership journey, we welcomed Tej Dhaliwal, our in-house mortgage agent. Already this year, Tej has helped numerous homeowners refinance their mortgages, shop for the best rates and negotiate with lenders. We’re thrilled to have him on our bench and in your corner.

Strengthening Homeownership Through New Partnerships

In 2025, we established investment partnerships with Scotiabank and Black Opportunity Fund, expanding capital available to aspiring homeowners. We also expanded our partnership with LiUNA and are very proud of their continued confidence in us. These partnerships help us support more Canadians who are struggling with the down payment gap.

Ourboro in the News: 2025 Media Highlights

As housing affordability became one of Canada’s biggest conversations this year, talk of shared equity continued to spread and gained national attention.

This year, we were featured across numerous platforms, such as

- The Globe & Mail

- BNN Bloomberg

- Yahoo Finance

- TLDR Podcast by Wealthsimple

You can explore all media coverage on our Press page.

Why Co-ownership Matters in 2025

In 2025, we helped families, couples, and individuals secure homes faster than traditional saving, proving that shared equity is a sustainable and supportive option for many.

Meet José and Elaine, a couple who came to Canada from Brazil with the dream of giving their family stability and a place to truly call home. For years, they faced rising home prices and rental uncertainties, wondering if homeownership would ever be possible. But through Ourboro’s shared equity model, they found a partner who believed in their dream as much as they did.

You can watch their story unfold below.

What’s ahead for 2026

As we look toward the year ahead, Ourboro is committed to:

- Growing our network of institutional investors to further scale shared equity to those who need it.

- Expanding our mortgage and homeowner support services.

- Strengthening partnerships with government bodies, lenders and service providers to improve affordability and access.

- Remaining responsive to the changing needs of first-time homebuyers in an uncertain market.

We know the real estate landscape will continue to shift, and we’re committed to innovating alongside it.

A Thank You to Our Homeowners, Partners & Community

To everyone who applied, partnered with us, or purchased a home through co-ownership, thank you. In a year defined by uncertainty, your trust and resilience have meant everything to us.

We’re proud of what we achieved together in 2025, and are hopeful for what’s possible in 2026.

Watch our Chief Product Officer, Alex Kjorven, and our Relationship Team Manager, Jackie Ellis, highlight this year’s milestones below.