At Ourboro, our mission is to open doors for those who have been locked out of the housing market, empowering them to become both personally and financially resilient. To date, we’ve helped over 150 individuals and families achieve homeownership by contributing to their down payments.

Earlier this year, we analyzed the initial impact of our first 100 down payment investments and found that Ourboro homeowners were able to purchase a home an average of nine years earlier than they would have on their own. While only 22% of potential homebuyers believe they can afford a home in their current city, over 54% of Ourboro homeowners have managed to buy a home in the same region where they were previously renting.

But our efforts don’t stop there—we’re committed to exploring whether co-ownership offers the same benefits as traditional homeownership, such as improved health and well-being, increased civic engagement, and wealth creation. To assess this, we asked ourselves a key question: Does participating in a shared equity model significantly enhance a person’s quality of life?

Our Baseline Impact Study, conducted with researchers from Conestoga College, has provided some early results comparing the impacts of co-ownership versus renting—and all preliminary findings point to yes.

What Are the Benefits of Homeownership?

Research consistently shows that owning a home is linked to better physical and mental health, providing a stable and secure environment that can significantly reduce stress. Beyond the personal benefits, homeownership also contributes to wealth creation and fosters stronger civic engagement, making it a cornerstone of community development.

Who is Left Out?

Despite these advantages, many people, particularly those from marginalized communities, face significant barriers to entering the housing market. In fact, through an initial survey Ourboro conducted with researchers from the University of Waterloo and Conestoga College in 2023, we found that 20% of renters plan to buy a home in the next 12 months, but it’s likely that only 5% will be able to.

You can read more about the benefits of homeownership and those left out here.

How is Ourboro making a difference?

Ourboro’s Baseline Impact Study

Following the initial survey from 2023, in partnership with researchers from Conestoga College, we launched the Baseline Ourboro Impact Study—a ten-year study that tracks the impact homeownership has on our co-owners over time. The study will seek to answer our original question, “Does participating in a shared equity model significantly enhance a person’s quality of life?”

Ourboro homeowners were surveyed along with renters in Canada who have an annual household income above $100,000, have started saving for a downpayment, and fall into one of these three categories:

- Active Buyers: people who were currently taking steps to actively look and who indicated they were planning to purchase a home.

- Planning Buyers: people who were currently not actively looking but who indicated they were definitely planning to purchase a home.

- Considering Planning: people who were not currently taking steps to actively look but who indicated they were considering purchasing a home in the future; this group was not as committed to the idea of purchasing a home.

They were asked multiple questions to determine where they fell under the following categories:

- Overall happiness

- Economic resiliency

- Engagement in community life

- Access to high-quality education

- Perceived neighbourhood safety

- Access to adequate housing conditions

- Institutional trust

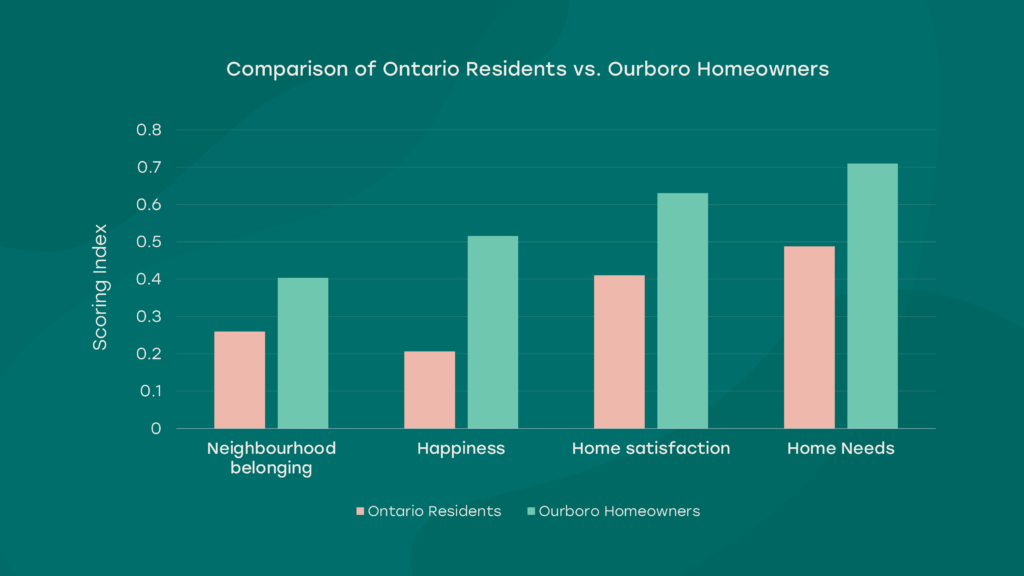

If participants responded with strongly agree and agree, they were scored positively and if they selected disagree or strongly disagree, they were scored negatively. This created a scoring index that ranges from -1 to 1. An overall average score was then given to each category based on their answers and the groups were compared.

Although this study will follow this cohort for the next ten years, preliminary data shows no significant differences within the three groups of renters, but Ourboro homeowners positively outrank these three groups in almost all categories.

When it comes to neighbourhood belonging, happiness, home satisfaction, and whether their home meets their needs, Ourboro homeowners ranked significantly higher. They also ranked lower for disorder—which describes feeling like their neighbourhood has unsafe characteristics. Ourboro clients also had a more positive outlook on the economy and were more likely to say that their economic situation would improve in the coming year (80.6%) versus the control groups.

Ourboro’s Postal Code Comparison

Through our partnership with Conestoga College researchers, we were also able to compare the neighbourhoods of Ourboro homeowners to the neighbourhoods they were previously renting in. We found that our homeowners moved:

- into areas whose residents, on average, have lower commute times.

- into neighbourhoods that spend 11% less on housing compared to the ones they rented in.

- into communities where more residents are living in homes that are suitable to their needs.

This shows that, on average, Ourboro co-owners are moving into neighbourhoods that are comparatively better than their previous rentals, and where we predict that their lifestyles and outcomes will eventually trend toward the averages of their new neighbourhoods.

A Bright Future for Co-ownership

We look forward to the next 10 years of this partnership with Conestoga and hope to shed even more light on the tangible benefits of co-ownership through the Baseline Ourboro Impact Study. This is just the beginning when it comes to using shared equity to even the playing field for those left out of the market. These findings highlight the potential of co-investment models like Ourboro’s to bridge the gap in homeownership accessibility, offering marginalized groups a path to homeownership and the health, social, and economic benefits that come with it.

You can read the full executive summary of the Baseline Impact Study results here.