What is equity?

The term equity may be new to some homebuyers, and how it works in a relationship between co-owners may differ from your own understanding. That’s why we wanted to take this opportunity to make sure we’re all on the same page about what equity means and how it’s shared between you and Ourboro.

You can think of equity as “risk capital” that both you and Ourboro put towards a home. This investment buys you an ownership interest in a property, but with no guarantee that it will be returned. Whether, or how much of, that investment gets returned to you is linked entirely to the value of the property. Ourboro doesn’t generate any profit through interest or rental income. Instead, we own the property with you and make money when the property increases in value, just like you do. If the home decreases in value, we both share in that loss and don’t see a return on our investment.

“Debt capital”, like a mortgage, is secured in the sense that the lender is guaranteed to get that money back, plus interest, even if the property value changes.

Working with Ourboro isn’t just about buying a home. We’ll own the home together too and, when you decide it’s time to sell, we’ll both share the home’s appreciation. Ourboro uses what we call the equity split to calculate our respective ownership shares in the home and how we will divide up the home’s appreciation when it is sold.

How do we determine the equity split when we co-buy a home?

When you purchase a home with Ourboro, you can choose to contribute anywhere from 5%-15% of the home value as equity, and Ourboro will top up the remainder to bring the total down payment to 20%. The percentage of the down payment that we each contribute translates into the percentage of equity, or ownership, we have in the home. This calculation is the equity split.

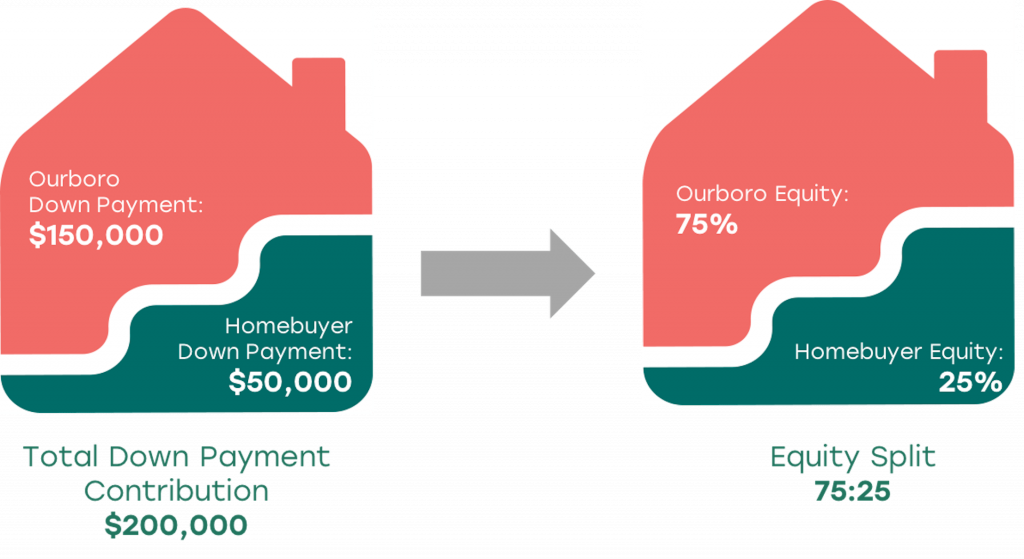

Say, for example, we’re co-buying a $1,000,000 home. You contribute 5% of the purchase price, ($50,000) and Ourboro contributes 15% ($150,000). Together, we have a 20% down payment of $200,000.

Since Ourboro contributed 75% of the total down payment ($200,000 x 75%= $150,000) and you contributed 25% ($50,000 x 25%= $50,000), the equity in the home would be split 75-25 for Ourboro and you, respectively

This means when the home is sold, we’ll split the appreciation 75-25.

What about my mortgage payments?

It’s important to note that, as the homebuyer living in the home, the mortgage will be your responsibility and your monthly mortgage payments do not increase your equity share. Instead, the money you paid towards your mortgage principal will be returned to you when the home sells, before we split what’s left according to our equity shares. It’s kind of like having your rent payments returned to you at the end of your lease!

We designed our model this way because our co-investment is based on equity and not debt. The principal payments you make on your mortgage go towards paying back a debt that you owe the bank. And, just as the bank doesn’t have equity in your home when they provide you a mortgage – your contributions toward paying off that mortgage does not increase your equity share when you sell the home.

Equity can be a confusing topic to understand but, put simply, equity really just means ownership. And it’s our ownership shares that determine how we split the home’s appreciation when it’s sold.

Unlock the market. Get started and see how Ourboro can help you buy the home you want, sooner.