It’s often said that purchasing a home will likely be the greatest financial investment an individual will ever make. While the financial side of owning a home is important, there are less obvious, but just as important, benefits that come with the title of homeowner.

Research consistently shows that owning a home is linked to better physical and mental health, providing a stable and secure environment that can significantly reduce stress. Beyond the personal benefits, homeownership also contributes to wealth creation and fosters stronger civic engagement, making it a cornerstone of community development. However, despite these advantages, many people, particularly those from marginalized communities, face significant barriers to entering the housing market.

Below we’ll explore the various ways homeownership impacts individuals and communities, while also addressing the challenges that prevent equitable access to these benefits.

Health and Well-being

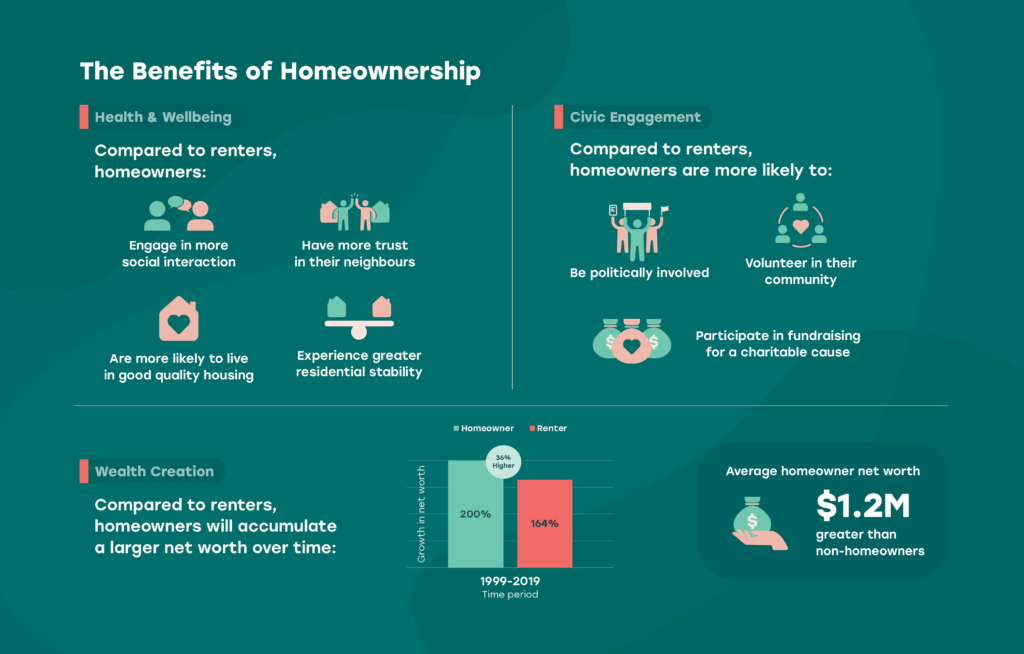

On average, homeownership has been associated with better physical and mental health.

Homeownership promotes stability, creating a more consistent and predictable living environment, reducing stress and fostering better overall mental well-being. A 2014 study published in the Journal of Social Science & Medicine found that homeowners are less likely to face the instability often associated with renting, such as the risk of eviction or rising rent costs, which can take a toll on mental health.

In terms of physical health, the study also revealed that homeowners are more likely to reside in neighbourhoods with better access to healthcare, recreational facilities, and healthier food options, further contributing to their well-being. Additionally, having the freedom to maintain and improve their living conditions for the long term, means homeowners can take an active role in lowering their risk of illness and other health issues.

Wealth Creation

Homeownership is a powerful driver of intergenerational wealth. According to the 2019 Survey of Financial Security, Canadians born between 1955 and 1964 have an average net worth that is $1.2 million greater than the average non-homeowner. And, individuals who became homeowners between 1999 and 2019 had their net worth grow 36% more than their renting peers.

For the average family in Ontario, real estate often represents the best opportunity for asset growth. From 2011 to 2021, while incomes increased by 38%, home prices surged by 180%, as reported by the Ontario Housing Affordability Task Force in 2022.

Civic Engagement

Homeowners tend to feel a deeper connection to their community, leading them to invest more in the neighbourhood’s development. Ourboro is committed to helping homeowners stay in the neighbourhoods they love, a recognition of the profound impact homeownership has on civic engagement.

A recent study by Habitat for Humanity found that homeownership is an important contributor toward residential stability. Which in turn is is related to improved life satisfaction, increased civic participation and educational outcomes for children, along with better physical and mental health.

Who is Left Out?

We know that certain demographics are consistently marginalized from homeownership. In fact, through a survey Ourboro conducted with researchers from the University of Waterloo and Conestoga College, we found that 20% of renters plan to buy a home in the next 12 months, but it’s likely that only 5% will be able to.

Marginalized Communities

Data from the Statistics Canada 2016 census shows that a number of visible minority populations consistently own fewer homes than their counterparts. There are a number of underlying factors contributing to the divergence in homeownership rates amongst racialized groups, however balancing the playing field to help these communities access homeownership is one of Ourboro’s key impact objectives. While surveying our co-owners, we found that 59% of them identify as visible minorities and 61% were born outside of Canada.

The Down Payment Gap

There are also many Canadians who, although they would make great candidates for homeownership on paper—with good income and credit— they still aren’t able to break into the market.

Many of our co-owners simply don’t have decades’ worth of savings or access to intergenerational wealth. During the survey conducted with researchers from Conestoga College and the University of Waterloo, it was found that 45% of renters feel saving enough for a down payment is one of the biggest barriers to homeownership.

How is Ourboro Helping?

At Ourboro, our mission is to open doors for those who have been locked out of the housing market, empowering them to become both personally and financially resilient. To date, we’ve helped over 150 individuals and families achieve homeownership by contributing to their down payments.

But our efforts don’t stop there—we’re committed to exploring whether co-ownership offers the same benefits as traditional homeownership. To assess this, we asked ourselves a key question: Does participating in a shared equity model significantly enhance a person’s quality of life?

To answer this question we have partnered with researchers from Conestoga College on a ten-year study. The Baseline Impact Study compares the impacts of shared equity versus renting—and all preliminary results point to yes, shared equity does enhance a person’s quality of life.

The Baseline Ourboro Impact Study findings highlight the potential of Ourboro’s shared equity model to bridge the gap in homeownership accessibility, offering marginalized groups a path to homeownership and the health, social, and economic benefits that come with it.

Dive into the detailed findings of the Baseline Ourboro Impact Study here.